michigan gas tax revenue

Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments. If a gallon of gas at the pump sells for 256 cents then 22 of the price is composed of federal and state taxes.

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Motor Fuel Tax Return filing deadlines have not changed.

. Assuming the same level of. They argue that the money people pay at the pump should go to fix roads. And to do this they want to direct the sales tax that gets levied on fuel to road repair.

Prepaid Diesel Sales Tax Rate Effective May 1 2022 the new prepaid gasoline sales tax rate is 255 cents per gallon. Pennsylvania the state that had the highest gas tax last year saw the highest gas tax increase of 79 cents per gallon the final increment of a 2013 law. House Republicans propose phasing out Michigans sales tax paid on gasoline replacing it with a higher state gas tax dedicated to fixing roads.

The United States federal excise tax on gasoline is 184 cents per gallon and 244 cents per gallon for diesel fuel. This rate will remain in effect through november 30 2021. The michigan gas tax amendment proposal m was on the 1978 ballot in michigan as a legislatively referred constitutional amendment.

The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the. MiMATS users should continue to use the MiMATS eServices portal. In 2019 revenues from the transportation fund were over 44 billion.

Depending on the jurisdiction some of the revenue from gasoline and diesel taxes can only be used for transportation related programs like improving infrastructure. Call center services are available from 800am to 445PM Monday Friday. Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they wrote.

2012 the mbt was replaced with a 6 corporate income tax. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the states School Aid Fund. 0190 State excise tax 4000 Pump price Gas at 350 per gallon 2939 Base retail price 0184 Federal excise tax 3123.

Gas Tax rate can vary from 283-363 cpg depending on area Other Taxes include 2071 USTInspection fee diesel 125 cpg state sales tax 2196 USTInspection fee gasoline The state excise tax is 75 cpg on gas and diesel additional 138 ppg state sales tax on diesel 118 ppg state sales tax on gasoline. This rate will remain in effect through May 31 2022. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the.

0263 represented the Michigan gasoline tax 0184 represented the Federal gasoline tax and 0141 represented the Michigan sales tax. Net income tax revenue totaled 13 billion in March 2022 a 1855 increase from the level in March 2021 and 8897 million above the level forecasted for the month. Michigan House Republicans especially House Speaker Lee Chatfield want to spend more on road repair without raising taxes.

Payment of Michigan Fuel Excise Taxes. Fund 026 Michigan Sales Tax 014 School Aid Fund 0103 Const. On top of other costs Michigan currently imposes a 19-cent per gallon excise tax on gasoline last updated in 1997 and a 15-cent per gallon excise tax on the in-state.

For general questions please email TreasMotFuelmichigangov. The fuel was used on a farm for farming purposes in carrying on a trade or. The 25 billion plan would increase the 26-cent fuel tax by 45 cents between this October and October 2020 and guarantee that the additional revenue is targeted to.

Michigan transportation fund. Motor Fuel Tax Mi. For general questions please email.

The plan which has not yet been formally introduced as legislation would phase out the first 4 percent of Michigans 6 percent sales tax on gasoline in the first year with the remainder following the next year. Withholding payments which represented a majority of gross income tax revenue were 85 above the year-ago level and 834. But that was based on.

FEDERAL AND STATE FUEL EXCISE TAX EXEMPTIONS. Michigan and Texas divert large portions of their gas tax revenue to education at 259 and 247 respectively. Figure 3 Crude Oil 146 Refining 034 DistributionMarketing 035 Federal Motor Fuel Tax 018 Mi.

Prepaid Gasoline Sales Tax Rate Effective May 1 2022 the new prepaid gasoline sales tax rate is 216 cents per gallon. These taxes are included in the price of fuel purchased at the pump. 120 cents per Michigan sales tax 6 of 200 TOTAL 567 cents.

LPG tax is due on the 20th of April July October and January Quarterly tax except for motor fuel suppliers 20th of each month. What is Motor Fuel Tax Revenue Used For. Michigan Gas Tax Revenue.

Have generated approximately 8183 million in sales tax revenue. The tax on regular fuel increased 73 cents per gallon and the tax on diesel fuel increased 113 cents per gallon equalizing both taxes at 263 cents per gallon. 2015 PA 179 earmarked 1500 million of GFGP income tax revenue to the Michigan Transportation Fund in FY 2018-19 3250 million in FY 2019-20 and 600 million in FY 2020-21 and each year thereafter.

Michigan Fuel Tax Reports. The revenue Michigan received from its motor fuel tax in fiscal year 2018 was 226 billion of which 259 or 5879 million was diverted to. Michigans Democratic Gov.

Based on the January 2022 consensus revenue estimates. Payments of fuel excise taxes are made by fuel vendors not by end consumers though the taxes will be passed on in the fuels retail price. 263 cents per Michigan motor fuel tax.

In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year. Beyond those aforementioned diversions both Utah and Vermont divert small portions of their revenue toward tourism promotion while Rhode Island diverts revenue to its Department of Human Services DHS an agency that cares for veterans the. 183 cents per federal excise tax.

The federal tax was last raised October 1 1993 and is not indexed to inflation which increased 93 from 1993 until 2022On average as of April 2019 state and local taxes and fees add 3424 cents to gasoline and 3589 cents to diesel for a total US volume-weighted. This rate will remain in effect through May 31 2022.

Michigan Sales Tax Where Does The Revenue Go And What Could An Increase Mean For Road Funding Mlive Com

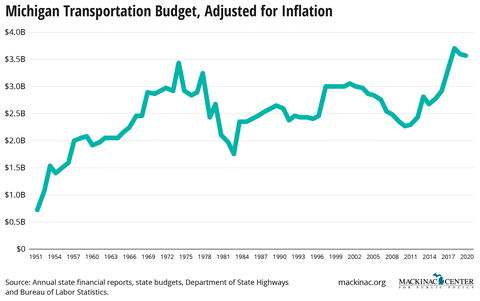

Less Road Funding From The Road Fixing Governor Mackinac Center

Michigan S Gas Tax How Much Is On A Gallon Of Gas

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Michigan Gas Tax Going Up January 1 2022

See How Much A 45 Cent Michigan Gas Tax Might Cost You Bridge Michigan

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Legal Experts Say Robinhood Is Not Legally Bound To Carry Out Every Trade And Is Protected From Class Action Lawsuits Securities And Exchange Commission Legal

Is The Michigan Lottery Really Helping Schools

The Edge Computing Report How Advances In Edge Computing Will Address Key Problems In The Healthcare Telecommunications And Automotive Sectors Health Care Emerging Technology Business Insider

Michigan Gas Utilities Charitable Giving Wec

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

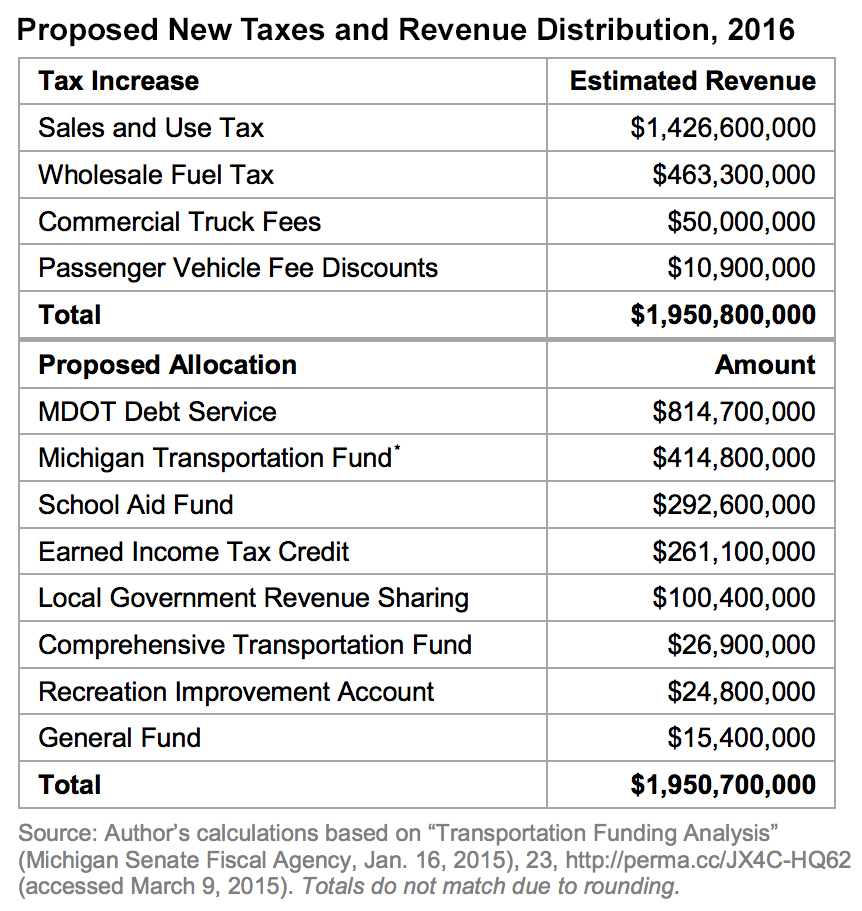

Michigan S May Tax Proposal Mackinac Center

Whitmer Vetoes Bill Suspending Michigan S 27 Cent Per Gallon Fuel Tax

Financial Information Ottawa County Road Commission

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan